New energy refrigerated trucks in the first eight months of 2024

Date:2024-10-14 Author:Olivia Source:www.chinaspv.com

Refrigerated trucks are a niche market among special-purpose vehicles, mainly used for home delivery of fruits and vegetables, medical delivery, and fresh food e-commerce delivery. With the rapid development of cold chain logistics, the refrigerated transport vehicle market has developed rapidly in recent years with the support of many favorable policies at the national and local levels. Among them, new energy refrigerated trucks have performed particularly well. In particular, the subsidy standard for newly purchased new energy urban refrigerated trucks issued by the state not long ago is 35,000 yuan/vehicle, which has effectively stimulated the growth of the new energy refrigerated truck market in August this year!

According to terminal registration data, 1,769 new energy refrigerated trucks were sold in August 2024, a 228% increase from 539 in August last year, a month-on-month increase of 51.7%, and sales hit a new high for each month since the beginning of this year!

The cumulative sales of new energy refrigerated trucks in the first eight months of 2024 were 7,506 (excluding exports, the same below), a 240% increase from the sales of 2,210 in the first eight months of 2023.

So what are the main characteristics of the new energy refrigerated truck market in the first eight months of 2024?

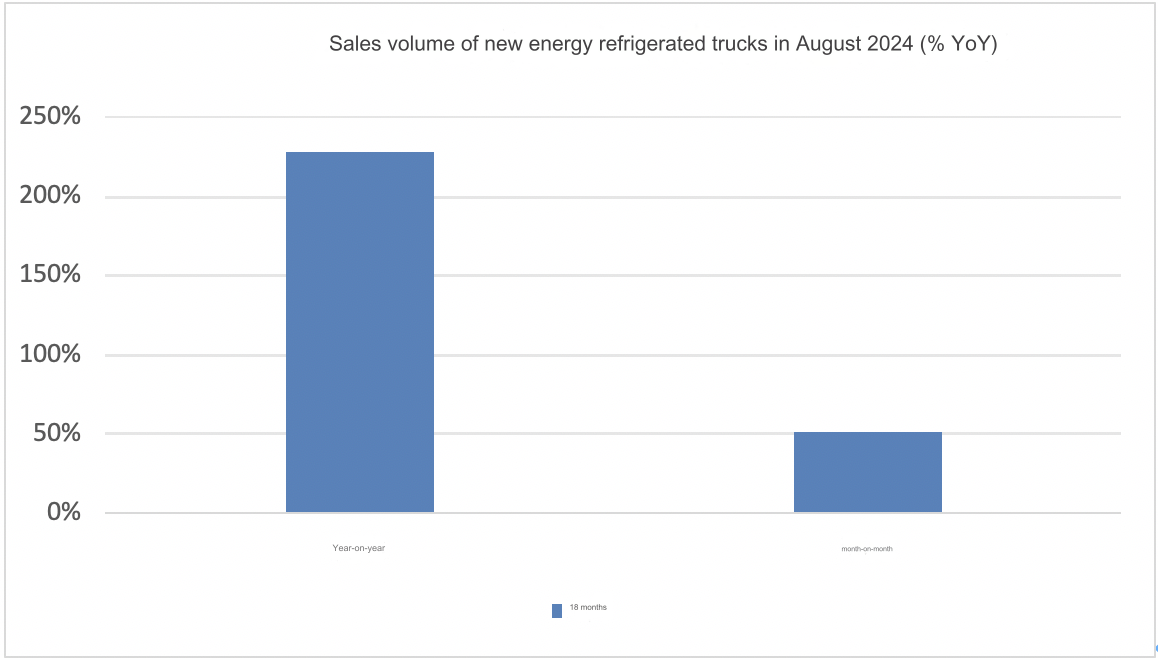

Feature 1: August sales both increased year-on-year and month-on-month

According to terminal registration data, domestic new energy refrigerated trucks sold 1,769 units in August 2024, up 228% year-on-year from 539 units in August last year, and up 51.7% month-on-month from 1,166 units in July this year, achieving a good development momentum of both year-on-year and month-on-month increases.

---A year-on-year increase of 228%, mainly due to the low sales base in the same period last year, and the policies supporting the development of the new energy refrigerated truck market since this year have been quite powerful, which led to a year-on-year increase in sales of new energy refrigerated trucks in August this year!

---A month-on-month increase of 51.7%, mainly due to the recent favorable policy of the state that the subsidy standard for newly purchased new energy urban cold chain distribution trucks is 35,000 yuan/vehicle, which will be implemented from August this year, and various places have issued implementation details of the old-for-new policy, among which new energy cold chain distribution trucks have been frequently reported, which has stimulated the increase in demand for new energy refrigerated trucks in August this year, resulting in a month-on-month increase in sales of new energy refrigerated trucks in August this year!

Feature 2: "8 consecutive increases", August sales hit a new high since the beginning of this year

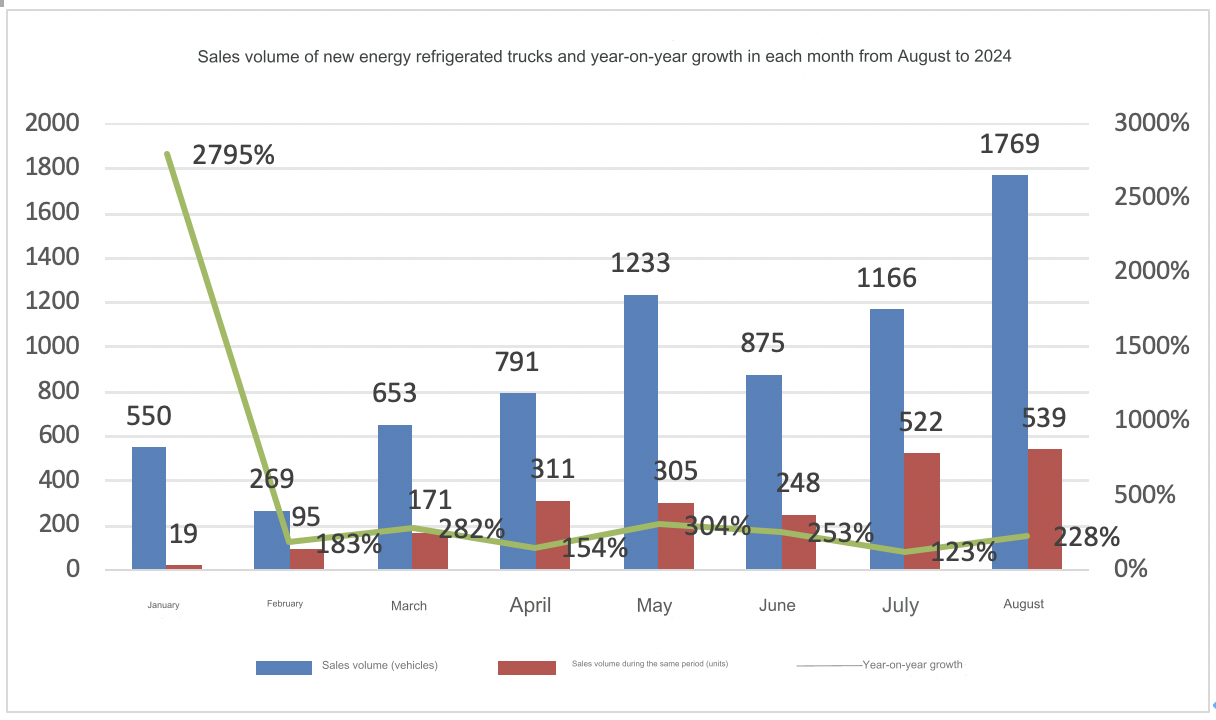

According to terminal registration data, the sales volume of new energy refrigerated trucks in each month from January to August 2024 and year-on-year:

As shown in the above figure:

---The sales volume of new energy refrigerated trucks in each month from January to August this year has performed "8 consecutive surges" year-on-year. The lowest increase was in July this year, which also increased by more than 1 times (123%), especially in January this year, which surged by 2795%. According to analysis, it is mainly due to the strong policy drive since this year.

Since March this year, the State Council issued the "Action Plan for Promoting Large-Scale Equipment Renewal and Consumer Goods Trade-in", and the market has maintained a high level of attention to the old-for-new policy. On July 24 this year, the National Development and Reform Commission and the Ministry of Finance jointly issued the "Several Measures on Strengthening Support for Large-Scale Equipment Renewal and Consumer Goods Trade-in". Recently, the Ministry of Transport and the Ministry of Finance jointly issued the "Notice on the Implementation of Scrapping and Renewal of Old Operating Trucks", further clarifying that the subsidy standard for newly purchased new energy urban cold chain distribution trucks is 35,000 yuan/vehicle! It is precisely because of the strong support of policies for the new energy refrigerated truck market since this year, coupled with the low sales base in the same period last year, that has led to the 8 consecutive surges in the sales volume of new energy refrigerated trucks in the first eight months of this year.

---From the monthly sales in the first eight months of this year, 1,769 new energy refrigerated trucks were sold in August this year, setting a new monthly high since January to August this year. The main reason is that starting from August this year, users who purchase new energy city refrigerated trucks can get a subsidy of 35,000 yuan per vehicle, which has increased the enthusiasm of users to purchase new energy refrigerated trucks in August this year.

Feature 3: August outperformed the new energy logistics vehicle market on a month-on-month basis and from January to August

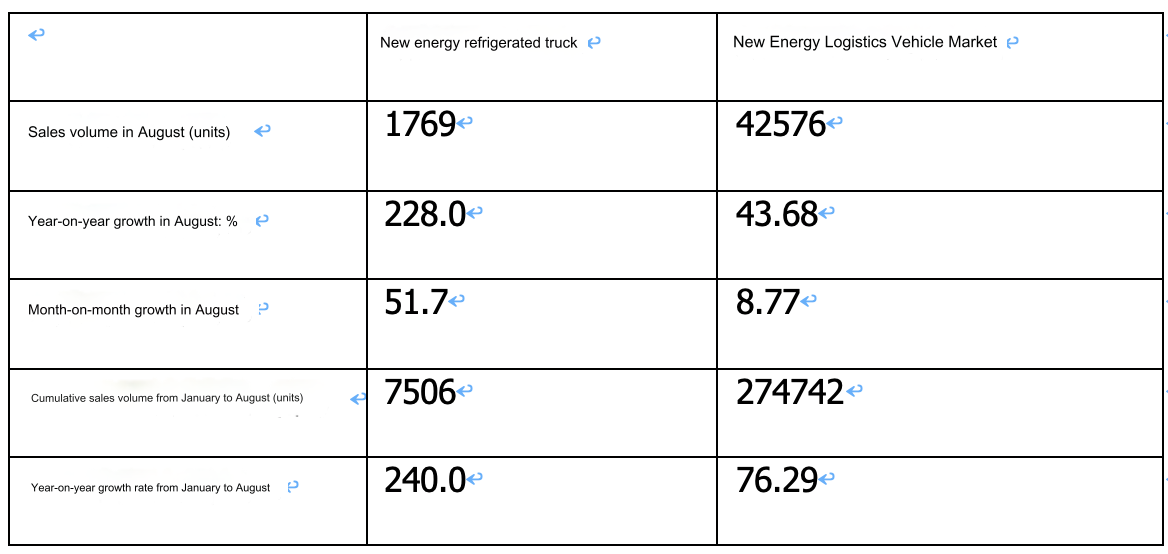

Table 1, based on terminal registration data, the comparison of new energy refrigerated trucks in August 2024 on a month-on-month basis and from January to August on a year-on-year basis with the new energy logistics vehicle market:

The above table shows:

---In August 2024, new energy refrigerated trucks increased by 228% year-on-year, far outperforming the 43.68% year-on-year growth rate of new energy logistics vehicles in August this year; in August 2024, new energy refrigerated trucks increased by 51.7% month-on-month, also far outperforming the 8.77% month-on-month growth rate of new energy logistics vehicles in August this year. It can be seen that both year-on-year and month-on-month, new energy refrigerated trucks in August this year outperformed the new energy logistics vehicle market in August this year.

---From January to August this year, new energy refrigerated trucks increased by 240% year-on-year, far outperforming the 76.29% year-on-year growth rate of new energy logistics vehicles in January to August this year.

According to analysis, it is mainly due to:

First, various policies supporting the development of new energy logistics vehicles have been further implemented in recent years, which has promoted the surge in the new energy refrigerated truck market in August this year and from January to August.

For example, the National Development and Reform Commission issued the "14th Five-Year Plan for the Development of Cold Chain Logistics", which clearly pointed out that it is necessary to accelerate the elimination of high-emission refrigerated trucks and encourage new or updated refrigerated trucks to adopt new energy models. This policy not only reflects the country's emphasis on green development, but also provides a clear direction and impetus for the development of domestic refrigerated trucks. In addition, local governments have also introduced corresponding support policies. For example, the Foshan Municipal Government of Guangdong Province provides different mileage subsidies for qualified pure electric trucks, including refrigerated trucks and other five new energy logistics and distribution vehicles;

In terms of technology research and development, the "14th Five-Year Plan for the Development of Cold Chain Logistics" issued by the State Council emphasizes the need to accelerate the research and development and manufacturing of light and micro new energy refrigerated trucks and refrigerated boxes, and actively promote new refrigerated trucks. This policy further clarifies the important position of new energy refrigerated trucks in my country's cold chain logistics, and also points out the direction for the development of new energy refrigerated trucks.

Second, the right of way for new energy refrigerated trucks is greater than that of traditional refrigerated trucks, making it easier for refrigerated trucks to enter the city;

Third, the continuous improvement of charging infrastructure in recent years has solved the problem of difficulty in charging new energy refrigerated trucks;

Fourth, the decline in vehicle prices brought about by the decline in battery prices has made it easier for cardholders to buy refrigerated trucks;

Fifth, the increase in new energy refrigerated trucks since this year has provided product support for outperforming the new energy logistics vehicle market.

According to the data from the Ministry of Industry and Information Technology, in the 8 batches of new energy light trucks announced from January to August this year (including the 379th batch to the 386th batch), the number of new energy refrigerated trucks on the list has increased significantly year-on-year, which undoubtedly provides product support for the surge in new energy refrigerated trucks in August and the first eight months of this year and outperforming the new energy logistics vehicle market.

It is the combined effect of the above-mentioned many favorable factors that led to the new energy refrigerated truck market outperforming the new energy logistics vehicle market in August and the first eight months of this year.

Feature 4: The dominant position of pure electric vehicles has weakened year-on-year; the proportion of hybrid vehicles has increased the most year-on-year, with the strongest momentum

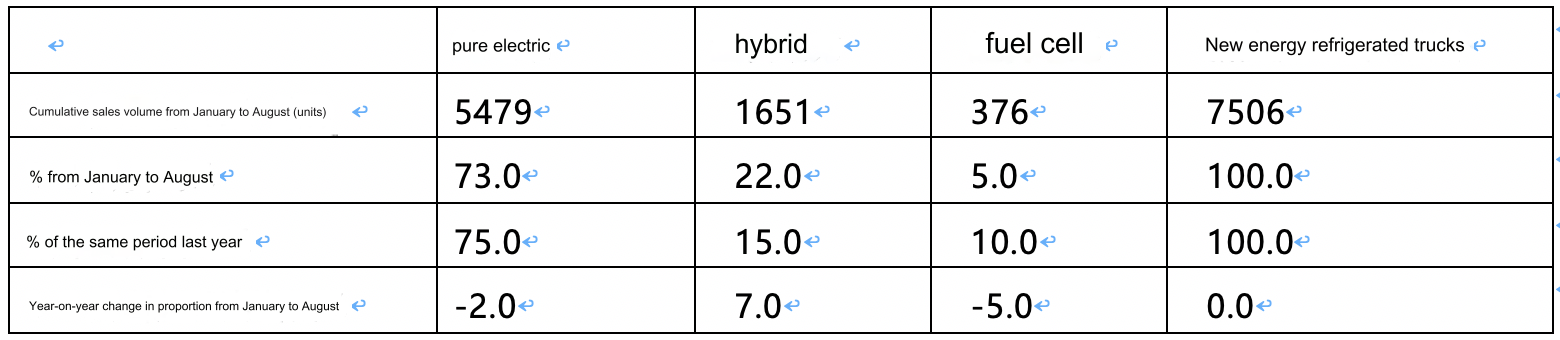

Table 2, based on terminal registration data, the sales volume, proportion and proportion of new energy refrigerated trucks of various technical routes from January to August 2024 increased by % year-on-year

As can be seen from the table above, in the year-on-year sales and proportion of various types of new energy refrigerated trucks from January to August 2024:

---A total of 5,479 pure electric refrigerated trucks were sold, accounting for 73% of the market share of new energy refrigerated trucks, occupying an absolute dominant position, but the proportion decreased by 2.0 percentage points year-on-year, indicating that its dominant position has weakened.

---A total of 1,651 hybrid refrigerated trucks were sold, accounting for 22% of the market, ranking second, and the proportion increased by 7 percentage points over the same period last year. It is the segmented model with the largest year-on-year increase and the "most popular" proportion. According to the analysis, the main reasons are:

First, there are many places with weak charging facilities, and pure electric refrigerated trucks are not convenient to charge, but hybrid light trucks are more suitable.

Second, the purchase cost of hybrid refrigerated trucks is lower than that of pure electric light trucks.

According to the author's understanding, the power battery cost of a pure electric refrigerated truck equipped with 100 kWh of electricity is about 150,000 yuan, weighs less than 1 ton (about 0.9 tons), the purchase price is about 200,000 yuan, and the vehicle curb weight is about 3 tons. The power battery capacity of a hybrid refrigerated truck of the same quality is generally selected to be 15-20KWh, and the price is about 160,000 yuan.

It can be seen that the price of a hybrid refrigerated truck of the same weight is 40,000 yuan cheaper than that of a pure electric light truck, which makes the hybrid refrigerated truck have a greater advantage in terms of purchase cost than a pure electric refrigerated truck. Especially in the current environment of "low freight rates, more vehicles and less goods", the return cycle of purchasing a hybrid refrigerated truck in a specific scenario is shorter than that of a pure electric refrigerated truck, and the market risk is relatively lower.

Third, hybrid refrigerated trucks can comply with the green license plate regulations.

According to current policies, as long as the range of hybrid refrigerated trucks in pure electric mode exceeds 50 kilometers, they can meet the green license plate regulations and enjoy the same road rights preferential policies as pure electric models.

Fourth, since this year, mainstream light truck companies and "new forces" in car manufacturing have launched technologically advanced hybrid refrigerated truck models, providing more product support for end users to choose hybrid light truck models.

According to statistics, more than 20 mainstream light truck companies, including Beiqi Foton, JAC Motors, Dongfeng Motors, FAW Jiefang, Yuancheng New Energy Commercial Vehicles, BYD, Weichai New Energy Commercial Vehicles, and Zhejiang Feidie Automobile, all have hybrid refrigerated truck products with advanced technology, which strongly supports hybrid. For example, the Aumark Zhilan HS series hybrid refrigerated truck launched by Foton Motor, its standard-load plug-in hybrid refrigerated model adopts the PS technology route, equipped with Oukang engine, matched with Mingheng CVT dual-motor hybrid transmission, and the shifting process is quiet and smooth. It is smooth, powerful, and the fuel consumption of the whole vehicle is only 7.16 liters per 100 kilometers, which can save 15-20% of fuel compared with the same level of fuel vehicles; for example, the hybrid No. 1 Junling Jubaopan refrigerated truck launched by JAC is equipped with Derun D2x2 plug-in dual-motor power split strong hybrid system. It has two power systems, one is the engine and the other is two motors. It can intelligently control the power output ratio of the engine and the motor according to different driving scenarios and road conditions to achieve the optimal oil-electric combination, and the cruising range can exceed 750 kilometers.

--- A total of 376 fuel cell refrigerated trucks have been sold, accounting for only 5% of the market, a year-on-year decrease of 5 percentage points, and it is the segmented model with the largest year-on-year decrease. This is mainly due to the high cost of promoting fuel cells and the small distribution of hydrogen refueling stations.

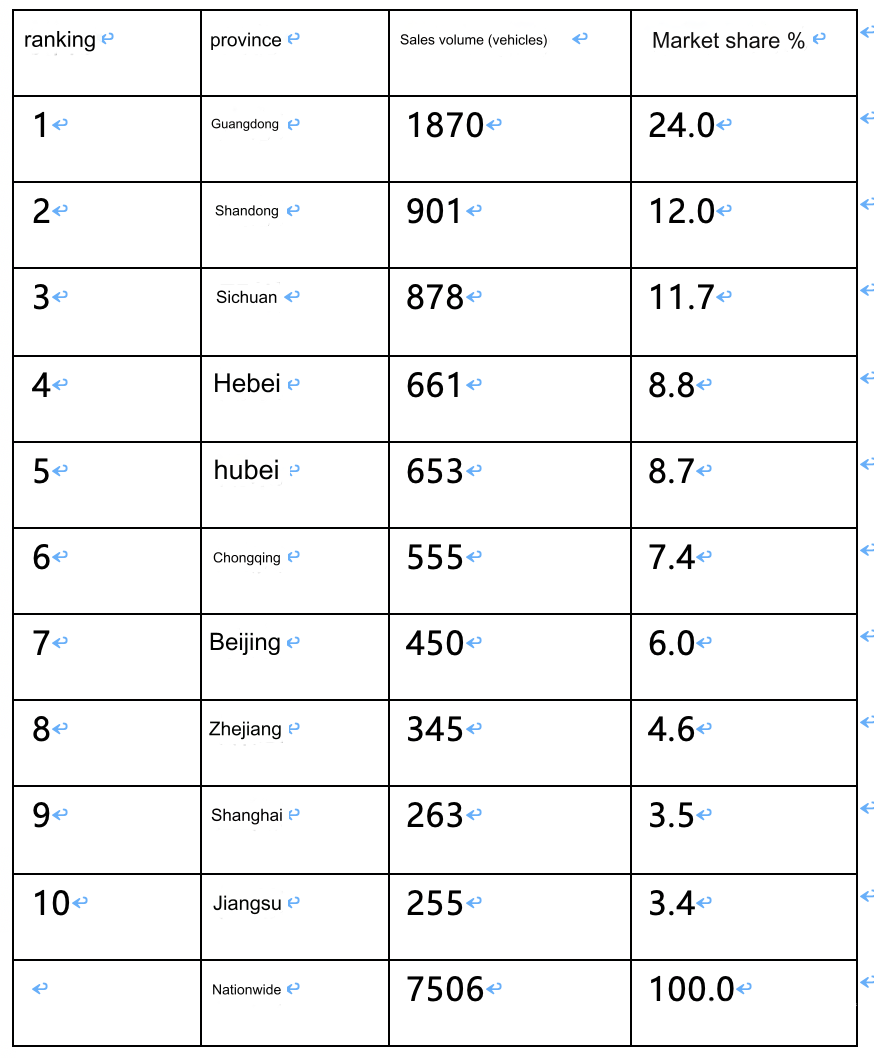

Feature 5: Guangdong, Shandong and Sichuan rank in the top three

Table 3, based on terminal registration information, the market share statistics of the top 10 provinces in the region of new energy refrigerated trucks from January to August 2024 are as follows:

The above table shows that in the regional flow of new energy refrigerated trucks from January to August 2024:

---Guangdong, Shandong and Sichuan ranked the top three, with market shares of 24.9%, 12.4% and 12% respectively;

---The cumulative sales share of the remaining provinces was less than 10%.

Views: