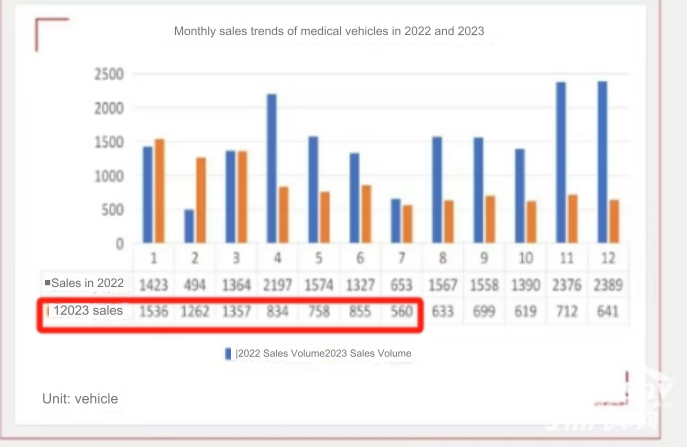

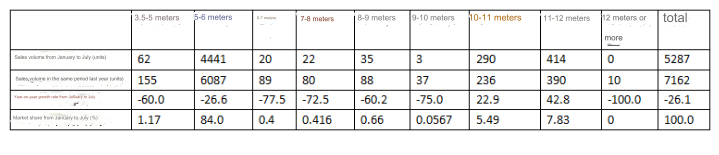

According to terminal registration information, my country's medical ambulances sold a total of 5,287 units in the first seven months of 2024, a year-on-year decrease of 26.1% from 7,162 units in January-July last year (see screenshot 1). This is mainly due to the reduction in market demand for medical special vehicles after the epidemic was completely lifted.

Screenshot 1, my country's medical vehicle sales in each month from January to July 2023 (data source: public terminal registration information)

So what are the main characteristics of my country's medical vehicle market in the first seven months of 2024?

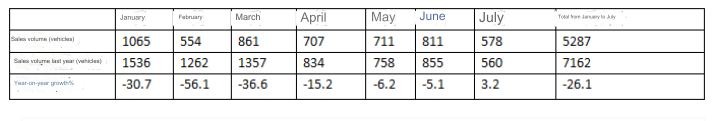

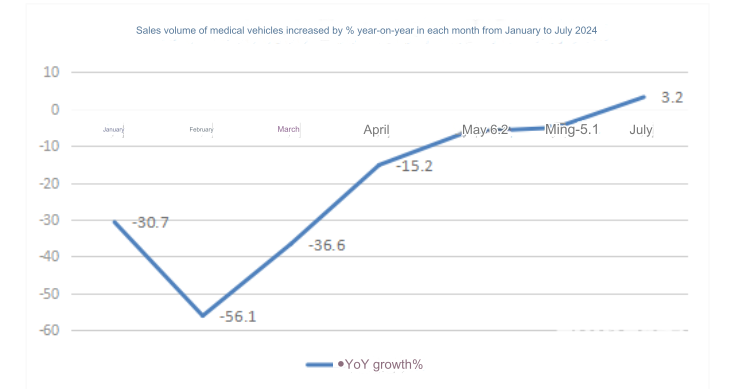

Feature 1. Monthly sales have successively performed the market trajectory of "6 consecutive declines and 1 increase" year-on-year

Table 1, based on terminal registration information, year-on-year and month-on-month statistics of ambulance sales in each month from January to July 2024

The above chart shows that the sales volume of medical vehicles in each month from January to July 2024 showed the following characteristics year-on-year:

The sales volume of each month showed the market trajectory of "6 consecutive declines-1 increase" in turn year-on-year, among which February had the largest decline, reaching 56.1% (probably related to the Spring Festival falling in February this year, which delayed the registration of the license plate in that month), and July was the only month with year-on-year growth (a slight increase of 3.2%). It can be seen that "decline" has become the "main tone" of the overall medical vehicle market in my country from January to July this year. From the perspective of monthly sales, except for January this year, when sales exceeded 1,000 vehicles, sales in other months were all below 1,000 vehicles. According to the analysis, the main reasons are:

First, the medical vehicle market is mainly related to policies and other factors; this year, due to the lack of epidemic prevention and control (there was still a peak in epidemic prevention and control in the first few months of last year), the demand for medical vehicles has decreased.

Second, the reshuffle of the medical vehicle industry has intensified, and the number of medical vehicle production and sales companies has decreased. According to terminal registration information, a total of 140 companies in my country achieved sales in 2022, which was reduced to 130 in 2023 and 118 in January-July this year. The shrinking number of medical manufacturers will definitely have a certain impact on the terminal sales scale of the medical special vehicle market since this year.

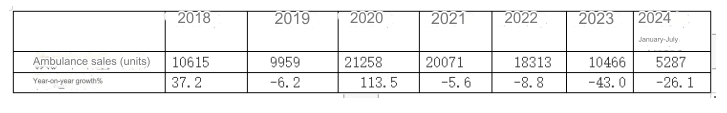

Feature 2: Negative growth for 4 consecutive years, and the growth rate ranked fifth in the past 6 years

Table 2, Statistics on the sales of medical special vehicles in my country from January to July 2018 to 2024 (data source: terminal registration information)

The above table shows that the cumulative sales of medical special vehicles in the first seven months of 2024 were 5,287, a year-on-year decrease of -26.1%, and the year-on-year growth rate ranked fifth in the past five years. This shows that the market for medical special vehicles in my country was relatively sluggish from January to July this year. The specific reasons have been briefly analyzed above.

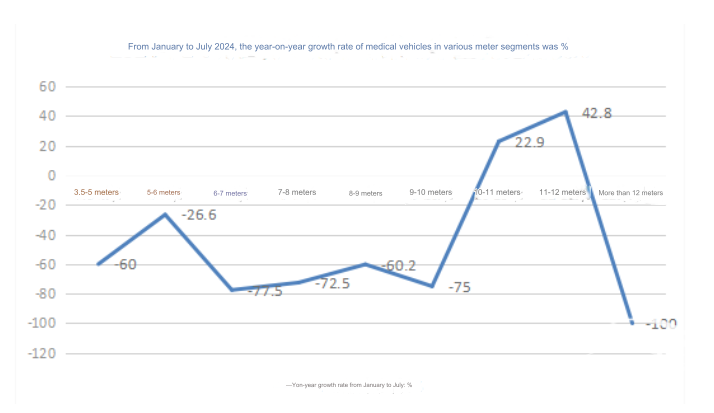

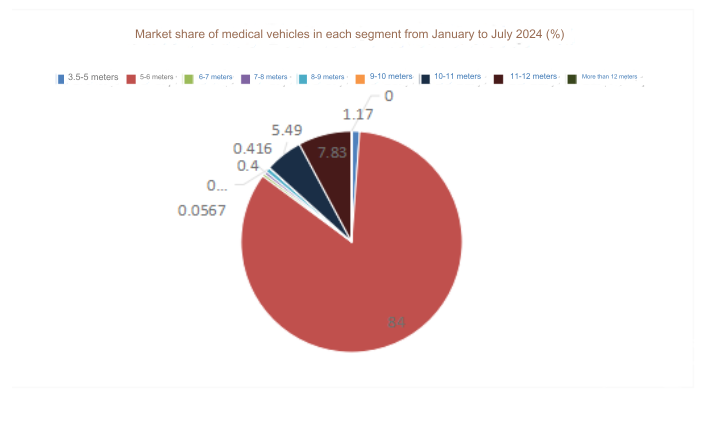

Feature 3: According to the analysis of meter segments, 5-6 meters accounted for more than 80% and led the way; 11-12 meters led the rise

According to the terminal registration data, divided by meter segment (length segment), the sales volume and year-on-year and proportion of medical special vehicles in my country from January to July 2024 are as follows:

Table 3, sales volume and year-on-year and proportion of ambulances in each length segment from January to July 2024 (data source screenshot 3 and terminal registration information)

Table 3, sales volume and year-on-year and proportion of ambulances in each length segment from January to July 2024 (data source screenshot 3 and terminal registration information)

The above chart shows that from January to July this year, the sales volume of ambulances in various length segments and the year-on-year growth showed the following characteristics:

---The cumulative sales volume of 11-12 meters segment was 414, a year-on-year increase of 42.8%, leading the growth of medical special vehicles in various meter segments, accounting for 8.2% of the market, ranking second; this type of vehicle is mainly used in the plasma procurement and transportation market.

---A total of 290 vehicles were sold in the 10-11 meter segment, a year-on-year increase of 22.9%, with a market share of 5.49%, ranking third;

---The sales of other meter segments were all below 100, and the market share was less than 1.5%.

Overall, 5-6 meters mainly focus on the medical ambulance market, and 11-12 meters large models lead the year-on-year growth.

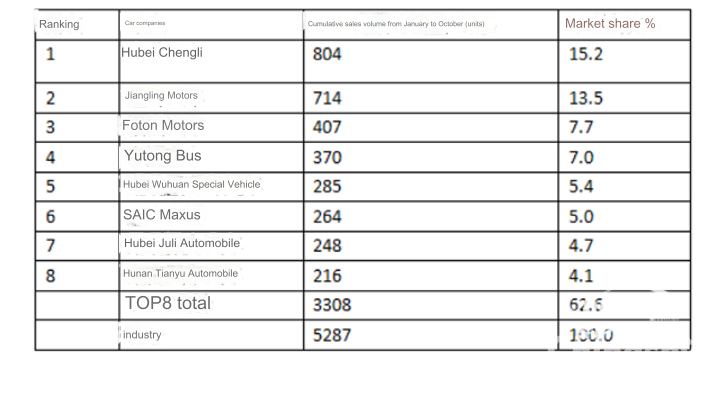

Feature 4: Chengli won the championship, Jiangling second, and Foton third

Table 4, based on terminal registration data, sales of the TOP8 medical special vehicles from January to July 2024 (only car companies with cumulative sales of more than 200 vehicles are counted) and proportion statistics:

The table above shows that in the market competition pattern of medical special vehicles from January to July this year:

---Hubei Chengli (including Chengli Co., Ltd. and Chengli Group) sold 804 vehicles in total, and it is also the only car company with sales exceeding 8,000 vehicles, accounting for 15.2% in total, ranking first.

---Jiangling Motors sold 714 vehicles in total, accounting for 13.5% of the market, ranking second;

---Foton Motor sold 407 vehicles in total, accounting for 7.7% of the market, ranking third

---Yutong Bus sold 370 vehicles in total, accounting for 7.0% of the market; ranking fourth;

---The cumulative sales of other car companies are all below 300 vehicles.

---TOP8 sold 3,308 vehicles in total, accounting for more than 60% (62.6%) in total. It can be seen that in the medical special vehicle market of more than 100 companies from January to July this year, the market concentration is still relatively high.

According to information, at present, the types of medical special vehicle manufacturers in my country are mainly divided into two categories: complete vehicle manufacturers and modified vehicle manufacturers. Among complete vehicle manufacturers, Jiangling (JSV Jiangling modified), Foton Motor (European and Japanese), SAIC Maxus and other light passenger vehicles are in a leading position; and among modified vehicle companies, Hubei Chengli is in a leading position in the industry.

In short, in the first seven months of this year, the cumulative sales of my country's medical special vehicle market were 5,287 vehicles, a year-on-year decrease of 26.1%, showing a relatively sluggish trend, among which 5-6 meters accounted for the majority, and 11-12 meters led the rise; Chengli won the championship, Jiangling second, and Foton third.