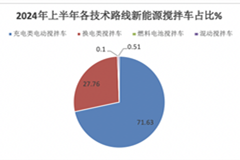

Screenshot 1, domestic heavy-duty truck terminal sales and year-on-year growth in June 2024 and the first half of the year (data source: registration data provided by the China Automobile Dealers Association)

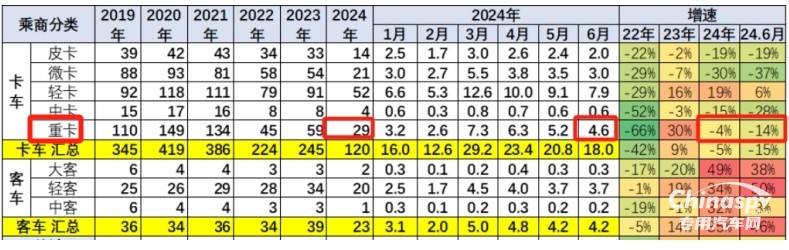

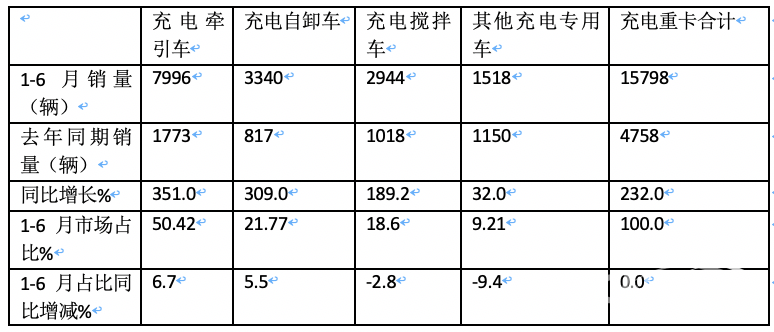

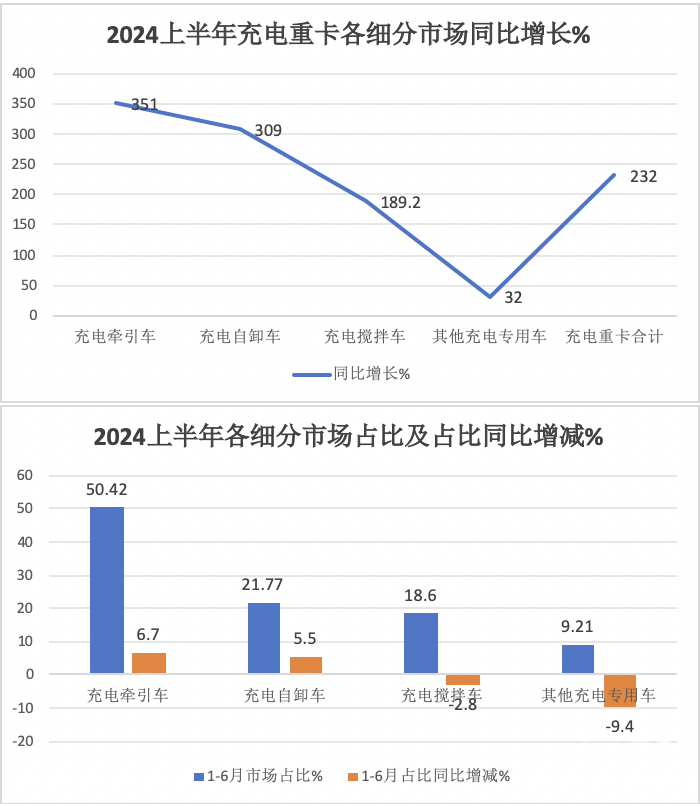

Screenshot 1, domestic heavy-duty truck terminal sales and year-on-year growth in June 2024 and the first half of the year (data source: registration data provided by the China Automobile Dealers Association)Despite this, the gas heavy-duty truck and new energy heavy-duty truck markets performed quite well, especially the new energy heavy-duty truck market was advancing all the way. Terminal registration data showed that in the first half of 2024, a total of 27,714 new energy heavy-duty trucks were sold in China, up 141% year-on-year, of which 15,800 (15,798) were sold in total, up 232% year-on-year, outperforming the 141% growth rate of the new energy heavy-duty truck market in the first half of this year by nearly 91 percentage points, accounting for nearly 60% of the overall new energy heavy-duty truck market in the first half of this year, occupying an absolute dominant position in the new energy heavy-duty truck market, and the proportion increased by nearly 15 percentage points year-on-year, which was the segmented model with the largest year-on-year increase in the domestic new energy heavy-duty truck market in the first half of this year. Therefore, it can be fully considered that the surge in my country's new energy heavy-duty truck market in the first half of this year was mainly driven by the rapid growth of charging heavy-duty trucks. In other words, charging heavy-duty trucks have become the biggest driving force for the rapid growth of my country's new energy heavy-duty trucks in the first half of this year. In particular, the performance of charging tractors and charging dump trucks is particularly eye-catching.

According to terminal registration data, among the 15,800 charging heavy-duty trucks sold in the first half of this year, a total of 7,966 charging tractors were sold, a year-on-year increase of 351%, outperforming the year-on-year growth rate of 232% of charging heavy-duty trucks in the first half of this year by nearly 119 percentage points, accounting for more than half of the market share of the charging heavy-duty truck market in the first half of this year (50.42%), and the proportion increased by 6.7 percentage points year-on-year, leading the charging heavy-duty truck market in the first half of this year, becoming the biggest core force driving the substantial growth of the charging heavy-duty truck market in the first half of this year!

Among the 15,800 charging heavy-duty trucks sold in the first half of this year, a total of 3,439 charging dump trucks were sold, a year-on-year increase of 309%, outperforming the year-on-year growth rate of 232% of charging heavy-duty trucks in the first half of this year by nearly 77 percentage points, accounting for more than 20% of the market share of the charging heavy-duty truck market in the first half of this year (21.77%), and the proportion increased by 5.5 percentage points year-on-year; becoming the second largest force driving the substantial growth of the charging heavy-duty truck market in the first half of this year!

Among the 15,800 rechargeable heavy-duty trucks sold in the first half of this year, 2,944 rechargeable mixer trucks were sold, a year-on-year increase of 189.2% from 1,018 last year, which was nearly 43 percentage points lower than the 232% year-on-year growth rate of rechargeable heavy-duty trucks in the first half of this year. They accounted for less than 20% of the market share (18.6%) of the rechargeable heavy-duty truck market in the first half of this year, and the proportion decreased by nearly 2.8 percentage points year-on-year; they became an important force to curb the substantial growth of the rechargeable heavy-duty truck market in the first half of this year!

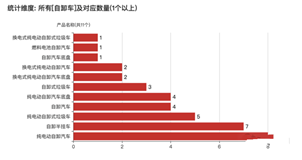

Table 1, sales share and proportion of various types of rechargeable heavy-duty trucks from January to June 2024 (data source: terminal registration information):

So what is the competitive landscape of charging tractors, charging dump trucks, and charging mixer trucks in the first half of this year? What are the sales and rankings of major competing companies?

Sales ranking of charging tractors in the first half of 2024: Sany wins the championship; XCMG and Sinotruk rank second and third

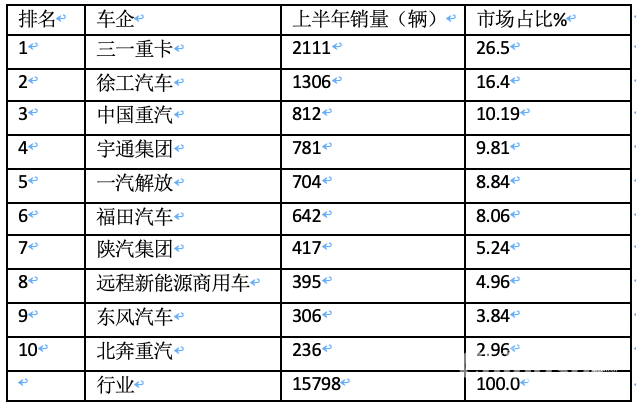

Table 2, based on terminal registration data, sales and share of the top 10 car companies with cumulative sales of charging tractors in the first half of 2024:

The above table shows that among the top 10 companies with cumulative sales of charging tractors in the first half of 2024:

---Sany Heavy Truck has sold 2,111 vehicles in total, and is the only company with sales exceeding 2,000 vehicles, accounting for 26.5% of the total, winning the championship;

---XCMG Automobile has sold 1,306 vehicles in total, and is the only car company with cumulative sales exceeding 1,000 vehicles, with a market share of 16.4%, ranking second;

----China National Heavy Duty Truck has sold 812 vehicles in total, ranking third, accounting for 10.19% of the total;

---Yutong Group and FAW Jiefang sold 7 81 and 704, accounting for 9.81% and 8.84% respectively, ranking fourth and fifth in the industry respectively;

---Foton Motor sold 604 vehicles in total, ranking fifth, accounting for 8.06% in total;

---The remaining automakers' cumulative sales were all below 500, and their market share was less than 5.5%;

Sales ranking of charging dump trucks in the first half of 2024: Sinotruk won the championship, Sany and XCMG ranked second and third;

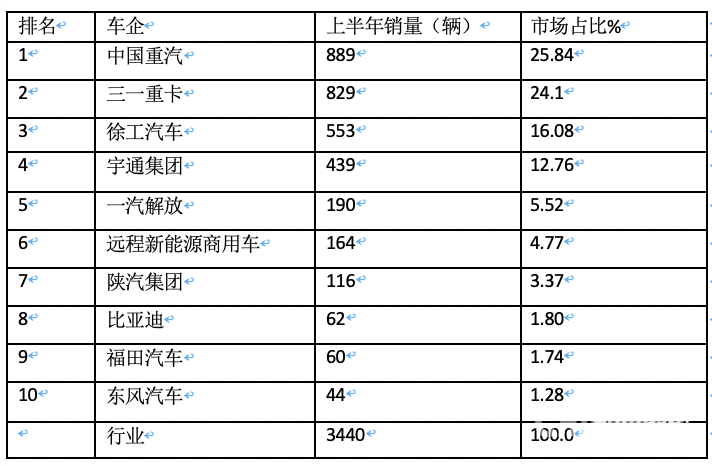

Table 3, based on terminal registration data, the cumulative sales and share of the TOP10 automakers of charging dump trucks in the first half of 2024:

The above table shows that among the top 10 companies with cumulative sales of charging dump trucks in the first half of 2024:

The above table shows that among the top 10 companies with cumulative sales of charging dump trucks in the first half of 2024:---SINOTRUK sold 889 vehicles in total, making it the only automaker with sales exceeding 800 vehicles, accounting for 25.84% of the total, ranking first;

---Sany Heavy Truck sold 829 vehicles in total, making it the only automaker with cumulative sales exceeding 800 vehicles, accounting for 24.1% of the market, ranking second;

----XCMG sold 553 vehicles in total, ranking third, accounting for 16.08% of the total;

---Yutong Group sold 439 vehicles in total, ranking fourth, accounting for 12.76%;

---FAW Jiefang has sold 190 vehicles in total, accounting for 5.52% in total, ranking fifth;

---Remote New Energy Commercial Vehicle has sold 164 vehicles in total, accounting for 4.77% in total, ranking sixth;

---The remaining automakers have a cumulative sales volume of less than 150 vehicles, and their market share is less than 4%;

Sales ranking of charging mixer trucks in the first half of 2024: XCMG won the championship, Sany and Zoomlion ranked second and third;

Table 4, based on terminal registration data, sales and share of the TOP10 automakers with cumulative sales of charging mixer trucks in the first half of 2024:

The above table shows that among the top 10 companies with cumulative sales of charging mixer trucks in the first half of 2024:

--XCMG Automobile has sold 859 vehicles in total, making it the only automaker with sales exceeding 800 vehicles, accounting for 29.2% of the total, ranking first;

--Sany Heavy Truck has sold 849 vehicles in total, making it the only automaker with cumulative sales exceeding 800 vehicles, accounting for 28.8% of the market, ranking second;

----Zoomlion has sold 645 vehicles in total, ranking third, accounting for 22% of the total;

--The remaining automakers have cumulative sales of less than 300 vehicles, and their market shares are all less than 9%;