Terminal registration data show that in June 2024, 769 new energy mixer trucks were sold, an increase of 53.5% year-on-year from 501 in June last year, and a decrease of 15.5% from 900 in May; from January to June 2024, a total of 4,110 new energy mixer trucks were sold, a year-on-year increase of 117.5%.

So what are the main characteristics of the new energy mixer truck market from January to June 2024?

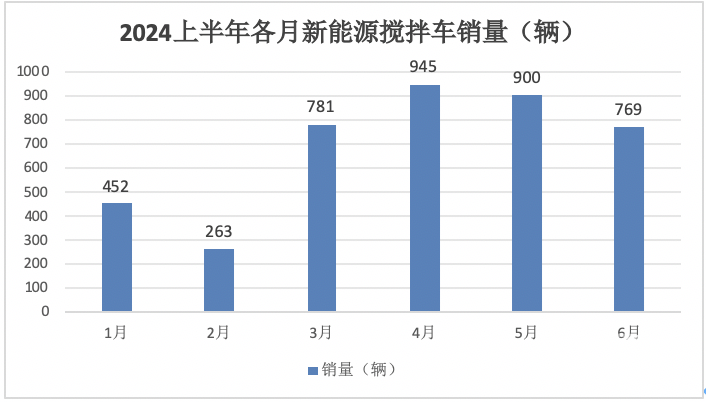

Feature 1. The sales volume of each month showed low in the front, high in the middle, and low in the back, and the market was slightly sluggish in June

According to terminal registration data, the sales volume of new energy mixer trucks in each month from January to June 2024:

The above chart shows that among the monthly sales from January to June this year, the sales in the first two months were relatively low (none exceeded 500 units), and the sales in the middle three months of March, April and May were 781, 945 and 900 units respectively, which were relatively high; and in the later June, the sales fell to 769 units, ranking the third lowest among the months from January to June this year. The sales in June fell by 15.5% month-on-month from May, indicating that the new energy mixer truck market in June this year did not show signs of a new high in the middle of the year, indicating that the new energy mixer truck market in June this year was sluggish. According to analysis, it is mainly due to the current sluggish real estate market, and there are not many new infrastructure projects that have been put into operation, so the demand for new energy mixer trucks in June has decreased.

Feature 2: Outperforming in June and underperforming in January-June

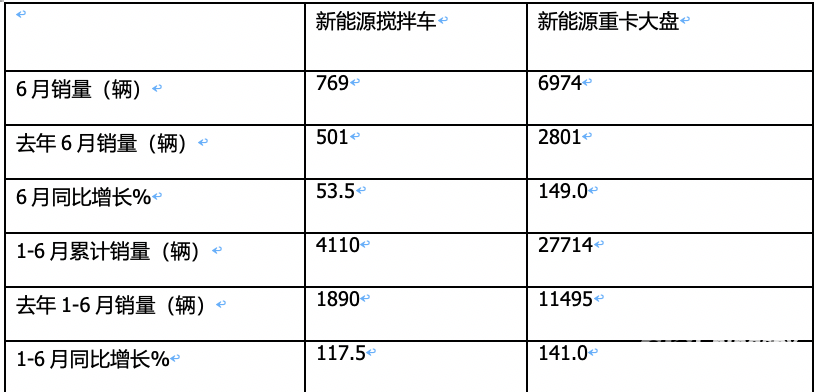

Table 1, year-on-year comparison of new energy mixer trucks and new energy heavy trucks in June 2024 and January-June (data source: terminal registration information)

The above table shows:

1. June 2024:

769 new energy mixer trucks were sold, a year-on-year increase of 53.5%, which was nearly 95.5 percentage points higher than the 149% growth rate of the new energy heavy truck market in June this year, and performed well;

2. January-June 2024:

The cumulative sales of new energy mixer trucks were 4,110, a year-on-year increase of 117.5%, which was nearly 23.5 percentage points lower than the 141% growth rate of the new energy heavy truck market in January-June this year.

It can be seen that whether it is in June this year or from January to June, new energy mixer trucks have underperformed the energy heavy truck market.

According to analysis, since new energy mixer trucks are mainly used for medium and short-distance sand and gravel aggregate transportation in engineering infrastructure, mining, real estate, etc., especially since this year, real estate and infrastructure projects have been relatively sluggish, and the year-on-year growth rate of demand for new energy mixer trucks is slower than that of tractors among new energy heavy trucks (new energy tractors increased by 189% year-on-year from January to June this year), and new energy tractors account for nearly 60% of the market weight of new energy heavy trucks, which greatly pushed up the year-on-year growth rate of the new energy heavy truck market in the first half of this year. In other words, due to the year-on-year surge in new energy tractors, new energy mixer trucks underperformed the new energy heavy truck market.

Third, the sales base of new energy mixer trucks in the same period last year was the lowest, which objectively provided data support for the year-on-year outperformance of new energy mixer trucks in April this year.

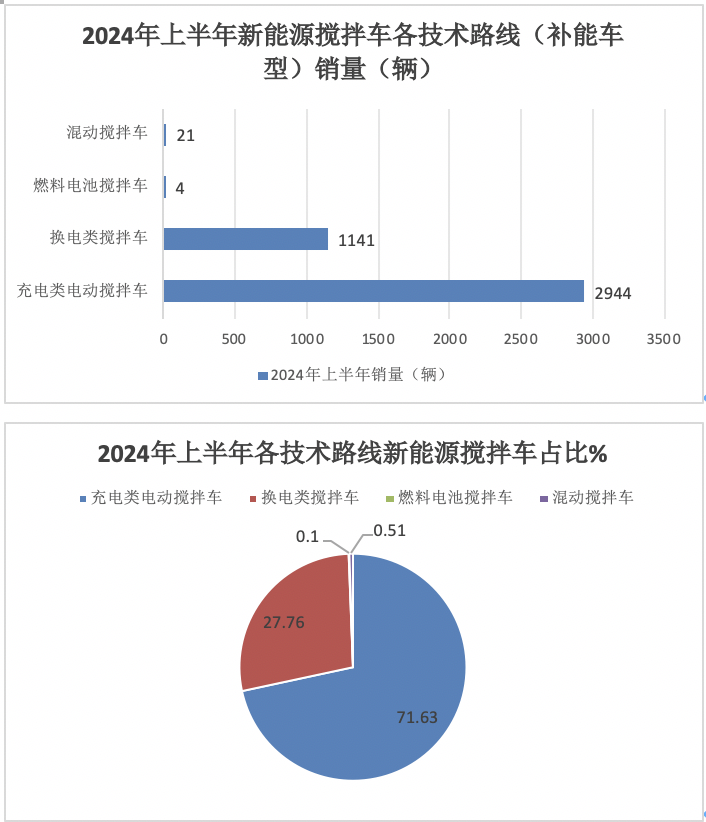

Feature 3: January-June: Charging mixer trucks accounted for more than 70% and were the absolute leader

Table 2, according to terminal registration information, divided by energy replenishment method and technical route, the sales and proportion of new energy mixer trucks from January to June 2024 are as follows:

As shown in the above figure, according to the technical route and charging method, in the sales structure of new energy mixer trucks from January to June this year:

---- Ordinary charging pure electric mixer trucks have sold a total of 2,944 units, accounting for more than 70% (71.63%) of the market, and they are in an absolute dominant position and leading the market; according to the research and analysis, the main reasons are:

First, new energy mixer trucks are operated in many scenes in urban areas, the transportation distance is not too long, and the requirements for cruising range are not high. Ordinary charging models can meet the daily cruising range requirements, so generally there is no need to replace the battery;

Second, ordinary charging piles are currently more widely distributed in urban areas, unlike the current distribution of battery replacement stations, which are still very rare. Therefore, charging new energy mixer trucks operating in cities is more convenient than battery replacement.

It can be seen that ordinary charging pure electric models occupy the dominant position in the new energy mixer truck market.

--- Battery replacement mixer trucks have sold a total of 1,141 units, accounting for 27.76% of the market, ranking second. According to the research and analysis, the main reasons are:

Battery replacement models have fast charging time and less initial purchase investment. At the same time, they solve the problem of insufficient cruising range in closed areas, so they are gradually welcomed by customers.

---Only 21 hybrid mixer trucks were sold, accounting for 0.51%;

---Only 4 fuel cell mixer trucks were sold cumulatively, accounting for less than 0.1%, which is almost negligible.

In short, "ordinary charging pure electric vehicles account for more than 70% and lead the way" is a basic feature of the new energy mixer truck market from January to June this year.

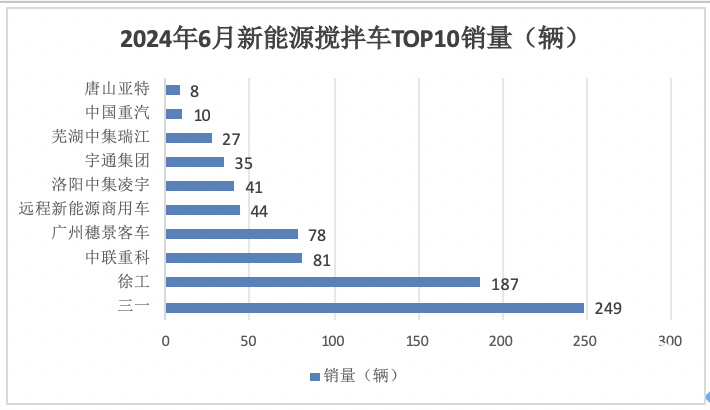

Feature 4: June: Sany ranked first, XCMG and Zoomlion ranked second and third

According to terminal registration data, the top 10 sales rankings of new energy mixer trucks in June 2024 are:

The above chart shows that among the TOP10 new energy mixer truck sales in June 2024:

--- Sany Automobile won the championship with 249 units sold, and it is also the only automaker with sales exceeding 200 units;

--- XCMG Automobile and Zoomlion Heavy Industry sold 187 and 81 units respectively, ranking second and third respectively;

--- The sales volume of other automakers is less than 80 units.

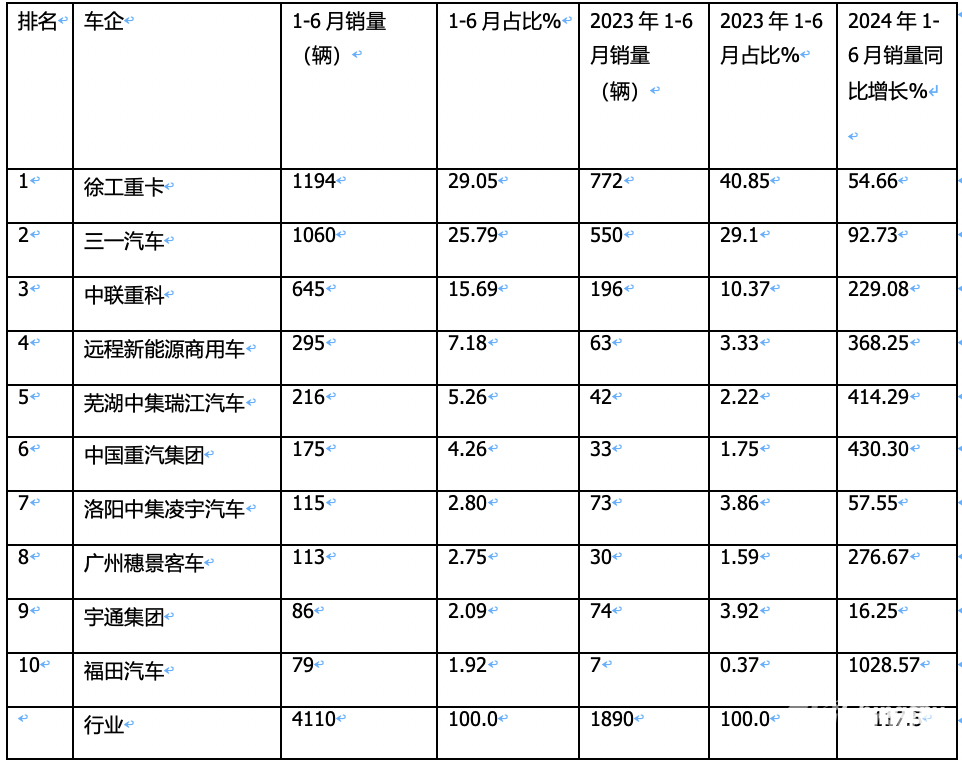

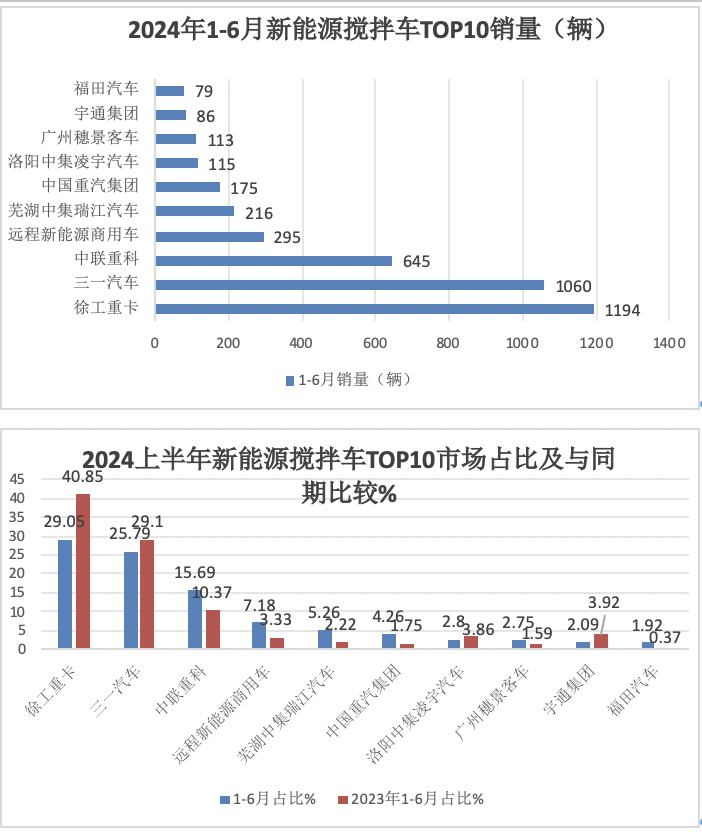

Feature 5: Cumulative sales from January to June: XCMG leads, Sany and Zoomlion rank second and third respectively; TOP10 all increased year-on-year, with Foton Motor leading the rise

Terminal registration data shows that from January to June 2024, a total of 18 automakers participated in the registration and sales of new energy mixer trucks. The sales statistics of the top 10 automakers are shown in Table 3.

Table 3, based on terminal registration information, sales analysis of the TOP10 new energy mixer truck companies from January to June 2024:

The above chart shows that in the sales of new energy mixer trucks from January to June 2024:

---XCMG Automobile sold a total of 1,194 vehicles, a year-on-year increase of 54.66%, underperforming the market, with a market share of 29.05%, winning the championship;

---Sany Automobile sold a total of 1,060 vehicles, a year-on-year increase of 92.73%, underperforming the market, with a market share of 25.79%, ranking second;

---Zoomlion sold a total of 645 vehicles, a year-on-year increase of 229.08%, outperforming the market, with a market share of 15.69%, ranking third;

---The cumulative sales of other car companies were all below 300 vehicles, and the market share was less than 8%.

---The TOP10 all increased year-on-year, with Foton Motor leading the way (1028.57%).

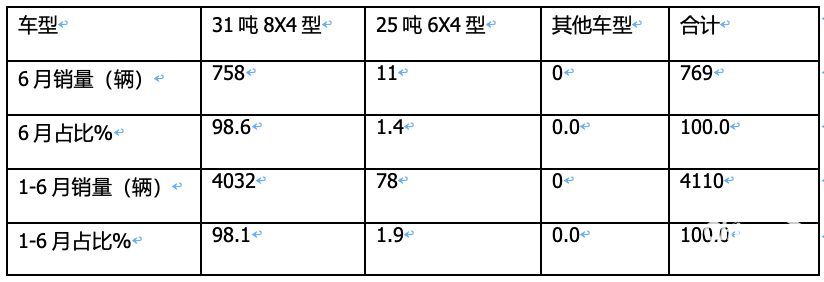

Feature 6: The main sales model is the 31-ton 8X4 new energy mixer truck, which occupies an absolute dominant position

Table 4, according to the terminal registration information, divided by drive form, the sales share of various types of new energy mixer trucks from January to June 2024:

The above table shows that, divided by drive type, among the models of new energy mixer trucks sold in June 2024 and January-June, the 31-ton 8X4 new energy concrete mixer trucks accounted for 98.6% and 98.1% respectively, both occupying an absolute dominant position, while the 6X4 25-ton models accounted for only 1.4% and 1.9% respectively.

According to research and analysis, this is mainly based on the new national regulations. The total weight of the 4-axle 8X4 mixer truck is 31 tons, which is 6 tons larger than the 6X4. Moreover, the tank volume of the mixer truck under the new regulations is much smaller than before. The current 8X4 mixer truck can load the same amount of concrete as the previous 6X4 25 tons. Because there have been many safety accidents involving mixer trucks on the market in recent years, the main reason is that the mixer trucks are seriously overloaded. On the other hand, the center of gravity of the vehicle itself is high, which is prone to rollover accidents. The reduction in tank volume has greatly reduced the actual profit of the car owner.