New Energy Refrigerated Trucks in the First Five Months of 2024

Date:2024-07-12 Author:Olivia Source:www.chinaspv.com

Refrigerated trucks are a niche market among special-purpose vehicles, mainly used for home delivery of fruits and vegetables, medical delivery, and fresh food e-commerce delivery. With the rapid development of cold chain logistics, the refrigerated transport vehicle market has developed rapidly in recent years with the support of many favorable policies at the national and local levels. Among them, new energy refrigerated trucks have performed particularly well. Especially after entering the hot summer, the demand for new energy refrigerated trucks is even more vigorous.

According to terminal registration data, 3,696 new energy refrigerated trucks were sold in the first five months of 2024 (excluding exports, the same below), a year-on-year increase of 310% from the sales of 901 vehicles in the first five months of 2023.

So what are the main characteristics of the new energy refrigerated truck market in the first five months of 2024?

Feature 1. The year-on-year growth rate far outperformed the new energy logistics vehicle market, and the proportion increased year-on-year

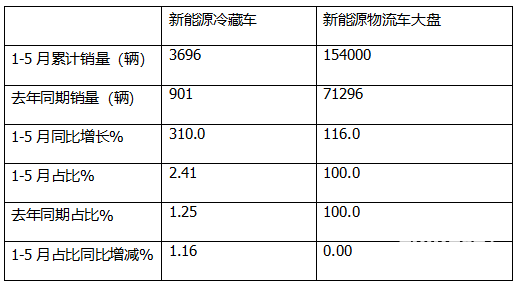

Table 1, according to terminal registration data, the year-on-year comparison of new energy refrigerated trucks with the new energy logistics vehicle market in the first five months of 2024:

The above table shows that from January to May 2024, new energy refrigerated trucks grew by 310% year-on-year, far outperforming the 116% year-on-year growth rate of new energy logistics vehicles from January to May this year, becoming a "bright spot" in the new energy logistics vehicle market in the first five months of this year. From the perspective of market share, new energy logistics vehicles accounted for 2.41% of the new energy logistics vehicle market from January to May this year, an increase of 1.16 percentage points year-on-year, indicating that the status of new energy refrigerated trucks in the overall new energy logistics vehicle market has been improved.

According to analysis, it is mainly due to:

First, various policies supporting the development of new energy logistics vehicles have been further implemented in recent years, which has promoted the surge in the new energy refrigerated truck market from January to May this year.

For example, the National Development and Reform Commission issued the "14th Five-Year Plan for Cold Chain Logistics Development", which clearly pointed out that it is necessary to accelerate the elimination of high-emission refrigerated trucks and encourage new or updated refrigerated trucks to adopt new energy models. This policy not only reflects the country's emphasis on green development, but also provides a clear direction and impetus for the development of domestic refrigerated trucks; in addition, local governments have also introduced corresponding support policies. For example, the Foshan Municipal Government of Guangdong Province provides different mileage subsidies to qualified pure electric trucks, including refrigerated trucks and other five new energy logistics and distribution vehicles;

In terms of technology research and development, the "14th Five-Year Plan for the Development of Cold Chain Logistics" issued by the State Council emphasizes the need to accelerate the research and development and manufacturing of light and micro new energy refrigerated trucks and refrigerated boxes, and actively promote new refrigerated trucks. This policy further clarifies the important position of new energy refrigerated trucks in my country's cold chain logistics, and also points out the direction for the development of new energy refrigerated trucks.

Second, the right of way for new energy refrigerated trucks is greater than that of traditional refrigerated trucks, making it easier for refrigerated trucks to enter the city;

Third, the continuous improvement of charging infrastructure in recent years has solved the problem of difficulty in charging new energy refrigerated trucks;

Fourth, the decline in vehicle prices brought about by the decline in battery prices has made it easier for truck friends to buy refrigerated trucks;

Fifth, leading companies such as Foton, JAC, and Sinotruk will focus on the layout of new energy refrigerated truck products as the focus of the future development of the new energy logistics vehicle market. This can be confirmed by the recent announcement of the 384th batch of new energy light trucks.

According to data from the Ministry of Industry and Information Technology, in the 384th batch of new energy light trucks, pure electric and hybrid light trucks (including 4.5-ton to 6-ton) were listed, including new energy trucks, new energy refrigerated trucks, new energy dump trucks, and a total of 58 new energy light truck models were listed, including pure electric (including battery replacement and charging), hybrid (including diesel hybrid, gasoline hybrid, methanol hybrid, etc.) and other technical routes. Among them, a total of 19 new energy refrigerated trucks were listed (excluding 5 models such as micro trucks), It accounts for 33% of the total number of new energy light trucks on the list. Among them, Yuancheng New Energy Commercial Vehicle has the most new energy refrigerated trucks on the list (a total of 4 models, including 2 pure electric refrigerated trucks and 2 methanol plug-in hybrid refrigerated trucks, all of which are 4.5-ton models with a wheelbase of 3360mm).

Foton (3 models on the list, 1 of which is a battery-swap model), XCMG (3 models on the list), JAC (2 models on the list), BYD (1 model on the list), Sinotruk (1 model on the list), Sany (1 model on the list), SAIC Light Truck (1 model on the list), Yutong (1 model on the list), etc. all have new energy refrigerated trucks on the list. From the perspective of technical routes, there are not only pure electric, but also plug-in extended-range hybrid and fuel cell models.

It can be seen that among the current top-ranked new energy light truck companies, almost all of them have new energy refrigerated trucks on the list in the 384th batch of announcements, providing product support for the surge in the new energy refrigerated truck market in the first five months of this year.

It is the combined effect of the above-mentioned favorable factors that led to the new energy refrigerated truck market outperforming the new energy logistics vehicle market from January to May this year.

Feature 2: The dominant position of pure electric vehicles has weakened year-on-year; the proportion of hybrid vehicles has increased the most year-on-year, with the strongest momentum

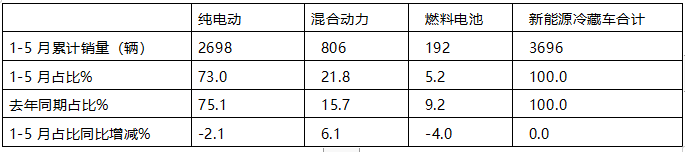

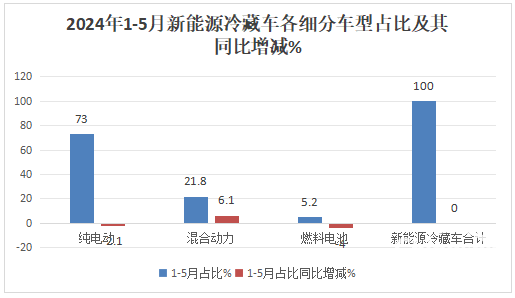

Table 2, based on terminal registration data, sales volume, proportion and proportion of new energy refrigerated trucks of various technical routes from January to May 2024 increased by % year-on-year.

As can be seen from the above chart, in the year-on-year sales and proportion of various types of new energy refrigerated trucks from January to May 2024:

---A total of 2,698 pure electric refrigerated trucks were sold, accounting for 73% of the market share of new energy refrigerated trucks, occupying an absolute dominant position, but the proportion decreased by 2.1 percentage points year-on-year, indicating that its dominant position has weakened.

---A total of 806 hybrid refrigerated trucks were sold, accounting for 21.8% of the market, ranking second, and the proportion increased by 6.1% over the same period last year, ranking second. It is the segmented model with the largest year-on-year increase and the "most popular" proportion. According to the analysis, the main reasons are:

First, there are many places with weak charging facilities, and pure electric refrigerated trucks are not convenient to charge, but hybrid light trucks are more suitable.

Second, the purchase cost of hybrid refrigerated trucks is lower than that of pure electric light trucks.

According to the author's understanding, the power battery cost of a pure electric refrigerated truck equipped with 100 kWh of electricity is about 150,000 yuan, weighs less than 1 ton (about 0.9 tons), the purchase price is about 200,000 yuan, and the vehicle curb weight is about 3 tons. The power battery capacity of a hybrid refrigerated truck of the same quality is generally selected to be 15-20KWh, and the price is about 160,000 yuan.

It can be seen that the price of a hybrid refrigerated truck of the same weight is 40,000 yuan cheaper than that of a pure electric light truck, which makes the hybrid refrigerated truck have a greater advantage in terms of purchase cost than a pure electric refrigerated truck. Especially in the current environment of "low freight rates, more vehicles and less goods", the return cycle of purchasing a hybrid refrigerated truck in a specific scenario is shorter than that of a pure electric refrigerated truck, and the market risk is relatively lower.

Third, hybrid refrigerated trucks can comply with the green license plate regulations.

According to current policies, as long as the range of hybrid refrigerated trucks in pure electric mode exceeds 50 kilometers, they can meet the green license plate regulations and enjoy the same road rights preferential policies as pure electric models.

Fourth, since this year, mainstream light truck companies and "new forces" in car manufacturing have launched technologically advanced hybrid refrigerated truck models, providing more product support for end users to choose hybrid light truck models.

According to statistics, more than 20 mainstream light truck companies, including Beiqi Foton, JAC Motors, Dongfeng Motors, FAW Jiefang, Yuancheng New Energy Commercial Vehicles, BYD, Weichai New Energy Commercial Vehicles, and Zhejiang Feidie Automobile, all have hybrid refrigerated truck products with advanced technology, which strongly supports hybrid. For example, the Aumark Zhilan HS series hybrid refrigerated truck launched by Foton Motor, its standard-load plug-in hybrid refrigerated model adopts the PS technology route, equipped with Oukang engine, matched with Mingheng CVT dual-motor hybrid transmission, and the shifting process is quiet and smooth. Smooth, powerful, the vehicle consumes only 7.16 liters of fuel per 100 kilometers, which can save 15-20% of fuel compared with the same level of fuel vehicles; for example, the hybrid No. 1 Junling Cornucopia refrigerated truck launched by JAC is equipped with Derun D2x2 plug-in dual-motor power split strong hybrid system, with two power systems, one is the engine and the other is two motors. It can intelligently control the power output ratio of the engine and the motor according to different driving scenarios and road conditions to achieve the optimal oil-electric combination, and the cruising range can exceed 750 kilometers.

--- A total of 192 fuel cell refrigerated trucks have been sold, accounting for only 5.2% of the market, a year-on-year decrease of 4 percentage points, and it is the segment with the largest year-on-year decrease. This is mainly due to the high cost of promoting fuel cells and the small number of hydrogen refueling stations.

Feature 3: Yuancheng, Meijin Energy Group and Foton Motor rank in the top three; TOP5 account for 65%

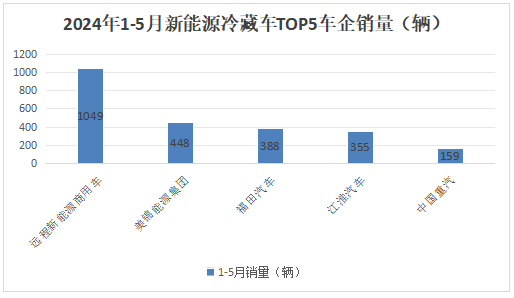

According to terminal registration data, the top 5 new energy refrigeration sales in the first five months of 2024:

As can be seen from the above figure, in the cumulative sales of new energy refrigerated trucks from January to May this year:

---Chengdu New Energy Commercial Vehicles has sold a total of 1,049 vehicles, and is also the only automaker with sales exceeding 1,000 vehicles, with a market share of 27%, winning the championship;

---Mei Jin Energy Group has sold a total of 448 vehicles, with a market share of 12.1%, and won the runner-up;

---Foton Motor has sold a total of 388 vehicles. With a market share of 10.5%, it won the third place;

---JAC Motors has sold a total of 355 vehicles, with a market share of 9.6%, ranking fourth;

---China National Heavy Duty Truck has sold a total of 159 vehicles, with a market share of 4.3%, ranking fifth.

---TOP5 has sold a total of 2,399 vehicles, accounting for 65% of the total.

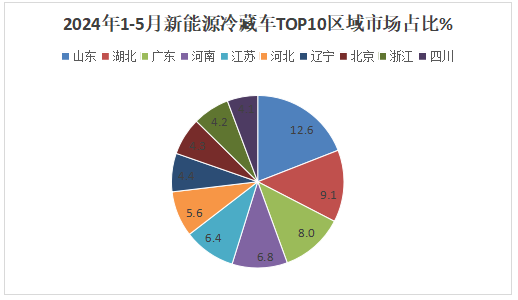

Feature 4: Shandong, Hubei, and Guangdong rank in the top three

Table 4, based on terminal registration information, the market share statistics of the top 10 provinces in the region of new energy refrigerated trucks from January to May 2024 are as follows:

The above chart shows that in the regional flow of new energy refrigerated trucks from January to May 2024:

---Shandong, Hubei and Guangdong ranked the top three, with market shares of 12.6%, 9.1% and 8% respectively;

---The cumulative sales share of the remaining provinces was less than 7%.

---The cumulative share of the TOP10 provinces exceeded 60%.

It can be seen that the regional flow of new energy refrigerated trucks from January to May 2024 was very uneven.