So what are the specific characteristics of RV sales in the first quarter of 2024? A brief summary and analysis is now provided.

Feature 1: Sales volume ranked second in the same period in the past 7 years, and the growth rate hit a new low

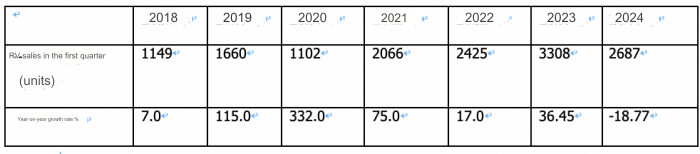

Table 1, based on terminal licensing data, RV sales and year-on-year statistics in the first quarter of the past seven years:

(Data source: terminal listing)

As can be seen from the table above, among the RV sales in the first quarter of the past seven years, the sales volume in 2024 was 2,687 units, ranking second in the same period in the past seven years. In terms of year-on-year growth, its growth rate was -18.77%, the lowest in the same period in the past seven years.

In short, RV sales in the first quarter of this year ranked second in the same period in the past seven years, but fell by nearly 20% year-on-year. According to analysis:

First, the sales base in the same period last year was relatively high (the highest in the same period in recent years), which put pressure on year-on-year growth in the first quarter of this year.

Second, the current economic environment is still not ideal. RVs are consumer goods, not necessities. It is more rational for consumers to buy RVs;

Third, the current statistics are based on the registration data of "recreational vehicles". Due to the 1750mm internal height requirement, the data of camper vans that have catered to the low-price consumer market are not included in the total.

It is the superposition of the above three factors that led to the year-on-year decline in the RV market in the first quarter of this year.

Feature 2: Vehicles below 6 meters in height account for the majority, and their dominant position has slightly decreased year-on-year.

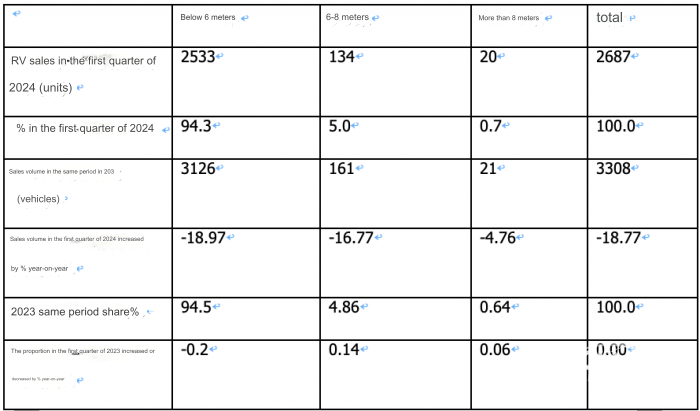

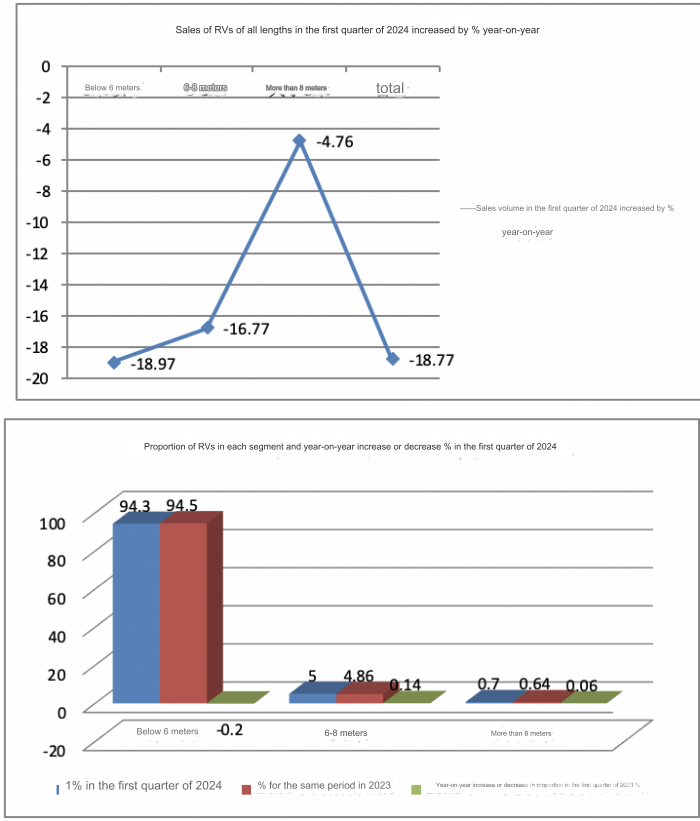

According to terminal licensing data, divided by the length of RVs, a total of 2,533 RVs under 6 meters were sold in the first quarter of 2024, accounting for 94.3% of the weight. The proportion decreased slightly year-on-year, but the absolute dominant position has not changed.

Table 2, divided by vehicle length segment, RV market sales and year-on-year statistics in the first quarter of 2024 and the same period in 2023 (data source: terminal licensing information)

The chart above shows:

---In the first quarter of 2024, a total of 2,533 RVs were sold in the 6-meter and below model segment, with sales increasing by -18.97% year-on-year; the market accounted for 94.3%, making it the absolute main part of the RV market in the first quarter of this year. According to research and analysis, the main reasons are:

First, due to the influence of driver's license, general users can achieve better driving safety and driver's license versatility by choosing a RV under 6 meters;

Second, it can hang a blue plate and enjoy better rights of way than a yellow-plate RV over 6 meters tall;

Third, RVs with a height of 6 meters or less are more economical and practical for current family outings; larger RVs not only cost more but also lead to a waste of resources.

The proportion of models under 6 meters in height decreased by 0.2 percentage points year-on-year, indicating that their dominant position has weakened year-on-year; according to research and analysis, the main reason is that the number of group tours in the RV market increased in the first quarter of this year, and the demand for RV models above 6 meters in height increased relatively.

----In the first quarter of 2024, a total of 134 RVs in the 6-8 meter segment were sold, with sales down 16.77% year-on-year, accounting for 5% of the market, and a year-on-year increase of 0.14%. It is the segment model with the largest year-on-year increase in share;

----In the first quarter of 2024, a total of 20 RVs with sections above 8 meters were sold, with sales increasing by 4.76% year-on-year, accounting for 0.7% of the market, ranking the smallest, and accounting for a year-on-year increase of 0.06%, making it the second largest year-on-year increase. Subdivided models.

In short, in the first quarter of this year, the 6-meter and below car segment was the absolute majority of the RV market, but its proportion decreased year-on-year, while the 6-8 segment models led the increase, and their share increased the most year-on-year.

Feature 3. According to the types of RV products, C-type RVs account for the largest sales volume and are the mainstream of the RV market at present, but their proportion has decreased year-on-year.

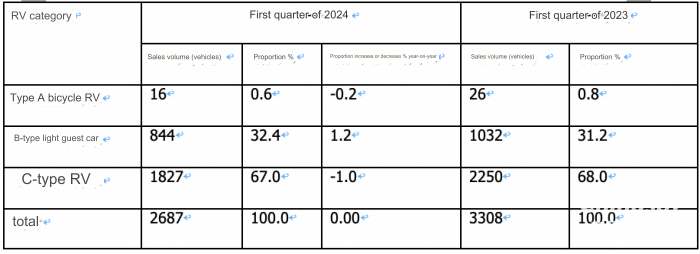

Table 3 shows the year-on-year increase or decrease in the sales volume, proportion and proportion of various types of RVs in the first quarter of 2024 according to product categories based on terminal licensing data:

As can be seen from the table above, the sales structure of RVs is divided by product type:

---In the first quarter of 2024, the cumulative sales of C-type RVs were 1,827 units, accounting for 67% of the market, making it the RV type with the highest proportion; however, the proportion decreased by 1 percentage point year-on-year, indicating that its dominant position has been significantly reduced. trend;

---In the first quarter of 2024, a total of 844 B-type light passenger cars were sold, accounting for 32.4% of the market, ranking second, and the proportion increased by 1.2 percentage points year-on-year;

---In the first quarter of 2024, a total of 16 Type A self-propelled RVs were sold, accounting for 0.6% of the market, ranking third, and the proportion decreased by 0.2 percentage points year-on-year;

Overall, according to the types of RV products, C-type RVs accounted for the largest share of sales in the first quarter of this year and are currently the mainstream of the RV market, but their dominant position has weakened year-on-year.

Feature 4: Maxus won the championship, Jiangling ranked second, and Weidelfen ranked third; the top 10 increased by 3 and decreased by 7 year-on-year, Luoyang Seven Wolves led the increase; the market share increased by 5 and decreased by 5 year-on-year, and Hubei Zhongheng increased the most

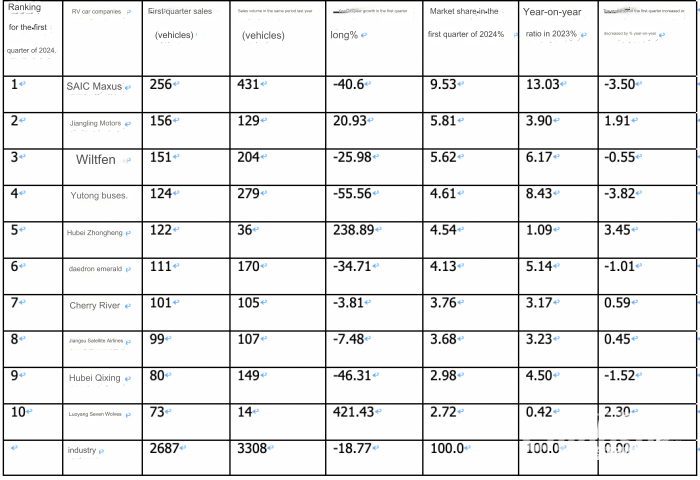

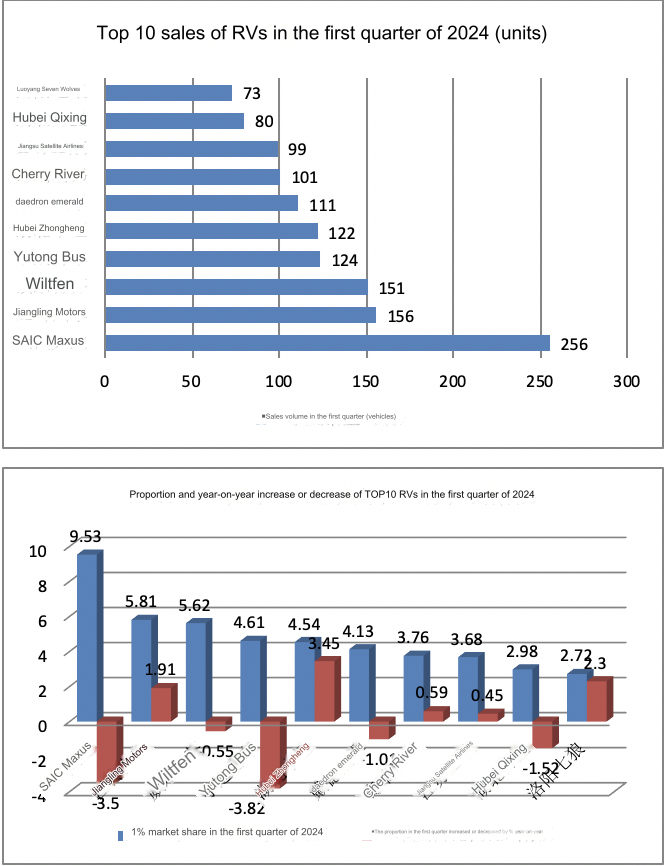

Table 4, sales ranking of the top 10 RV companies in the first quarter of 2024 (data source: public information)

The chart above shows that among the top 10 cumulative sales of RVs in the first quarter of 2024:

----SAIC Maxus has sold a total of 256 vehicles, a year-on-year decrease of 40.6%, with a market share of 9.53%, leading the RV market in the first quarter, and its market share decreased by 3.5 percentage points year-on-year, making it the second largest car company to reduce its market share year-on-year;

--- Jiangling Motors has sold a total of 156 vehicles, a year-on-year increase of 20.93%, with a market share of 5.81%, ranking second, a year-on-year increase of 1.91 percentage points, and the car company with the second largest market share increase year-on-year, performing well;

---- Wiltfen has sold a total of 151 vehicles, a year-on-year decrease of 25.93%, with a market share of 5.62%, ranking third, and a year-on-year decrease of 0.55 percentage points;

---The cumulative sales of other car companies are less than 150 vehicles, and the market share is less than 5%.

---Top 10 sales increased by 3% year-on-year and decreased by 7%, with Luoyang Seven Wolves growing the fastest (421.43%).

---The top 10 market share increased by 5% year-on-year and decreased by 5% year-on-year. Hubei Zhongheng’s share increased the most year-on-year (3.45%); Yutong Bus decreased the most (-3.82%).

In short, the RV market suffered a year-on-year decline in the first quarter of 2024, but sales still ranked second in the same period in the past seven years.